How Peach helps lenders stay compliant

One look at the running tally of CFPB enforcement actions is enough to inspire a healthy respect for the importance of lending compliance—especially as the steepest penalties swell into the billions of dollars.

But for lenders, compliance isn’t just a checklist of straightforward decisions. The inflexibility of legacy lending technology can make it difficult or impossible for lenders to fully comply with certain regulations. For example, one regulation that frequently poses challenges for lenders is the Servicemembers Civil Relief Act (SCRA), which entitles active-duty servicemembers to an interest rate cap of 6% during the period of their deployment. This interest rate cap can be requested retroactively, which presents a challenge: Most loan management systems are not capable of making retroactive changes at scale. As a result, many lenders are forced to approximate the interest benefit through service credits, exposing themselves to risk due to improper implementation. Lenders likewise face difficulty complying with the Fair Debt Collection Practices Act (FDCPA), among other regulations.

Peach was founded in large part because of the opportunity to improve upon the shortcomings of legacy lending infrastructure—including on the compliance front. Peach was designed from the beginning to accommodate all the regulatory requirements of lending as a routine part of daily operations. That’s why you’ll find a number of features, like Loan Replay™, that are uniquely designed to address widely acknowledged pain points such as retroactive changes and portfolio migrations.

Compliance Guard™ is the name of our compliance-focused platform module. Its functionality can be divided into two parts. First, our Compliance Guard Monitoring module scans for borrower status changes with compliance ramifications, like military status, reassigned numbers and bankruptcy. Second, our Compliance Guard Rules module scans outbound communications based on predefined (yet fully customizable) rules to ensure compliance with regulations like the U.S. Bankruptcy Code and Regulation F. We’ll take a detailed look at borrower status monitoring first.

Compliance Guard Monitoring

Peach is continually running processes to check relevant borrower statuses. For example, if a borrower is found to be bankrupt, sanctioned, deceased or on active duty, our system will automatically create a case for that person, which a lender’s agents can then review and take action on. Similarly, we monitor the Reassigned Numbers Database to determine whether borrowers’ phone numbers have changed, which helps ensure compliant communications. We also check for borrowers who live in areas declared by FEMA to be natural disaster zones, although there is no law requiring lenders to take proactive action in this scenario.

All our borrower status monitoring systems are automated. Once turned on for a lender, we will continually monitor for all relevant borrower statuses. All that’s required of the lender is to handle the incoming cases created by Peach’s system.

Our system is built to standardize the information lenders see, even though the sources of this information are far from uniform. This helps lenders to be able to focus on their core business. Lenders can always choose which types of monitoring they want—so if they don't want to conduct proactive SCRA monitoring, for example, they can choose to forgo it.

Monitoring for bankruptcy and deceased

We’re continually monitoring for borrowers who file for bankruptcy or pass away. Each time we receive a hit, we create a servicing case in the lender’s CRM for their agents to review. The case contains the match level for the hit—for example, the SSN, name and address could each match completely, partially or not at all. The case also contains additional metadata about the hit. For example, a bankruptcy case will show the court case filed date, the court case number, the bankruptcy chapter and the last status of the court case, among other data. A complete list of the fields we include for each case type can be found in our API documentation.

After a servicing case is generated, a lender’s agents can then leverage the flexibility of the Peach platform to perform a variety of actions, including triggering communications, setting do-not-interact rules, offering hardship solutions, waiving past fees, backdating payments and more. In the case of bankruptcy, because court cases can go on for months, our system will also continue to monitor progress, updating our internal data as the court case progresses.

OFAC monitoring

The U.S. Office of Foreign Assets Control (OFAC) is responsible for enforcing economic and trade sanctions. Lenders must periodically check to ensure they are not doing business with any borrowers who appear on a sanctions list.

Peach automatically searches the sanctions lists for every borrower on our platform. If we receive a hit, we’ll create a case in the lender’s CRM for their agents to review and take action on. We do this periodically so that lenders do not have to play an active role in the monitoring—they only need to handle the cases as they come in.

SCRA monitoring

The SCRA gives certain rights to borrowers who are on active military duty. So multiple times per week, we monitor for borrowers whose military status has changed, creating a case for each borrower. Agents can easily take appropriate action on SCRA cases, like lowering interest rates as of the current date or any past date—and waiving past fees, as necessary. For more detail, check out our SCRA compliance article.

Reassigned Numbers Database

Occasionally, the phone number on file for a borrower is reassigned to a new person, who by definition has not given permission to be contacted. If lenders are not aware of these reassigned numbers, they take on compliance risk. For that reason, we monitor the Reassigned Numbers Database for any numbers that have been reassigned or disconnected. We then update the contact object in our system with details, and we prevent further communication until consent is received again.

FEMA disasters

Even though it is not required by law, Peach tracks the occurrence of natural disasters so that lenders can provide leniency based on geographic location. We periodically pull FEMA’s list of declared disasters and identify any borrowers located within the bounds of those disasters, using the geographic coordinates of their addresses. We create a supercase for each disaster, which, unlike a normal case, applies to a group of borrowers. Once a supercase is created, the lender can decide whether they want to take action. If they do, they can automatically create individual cases for each borrower in the population.

Compliance Guard Rules

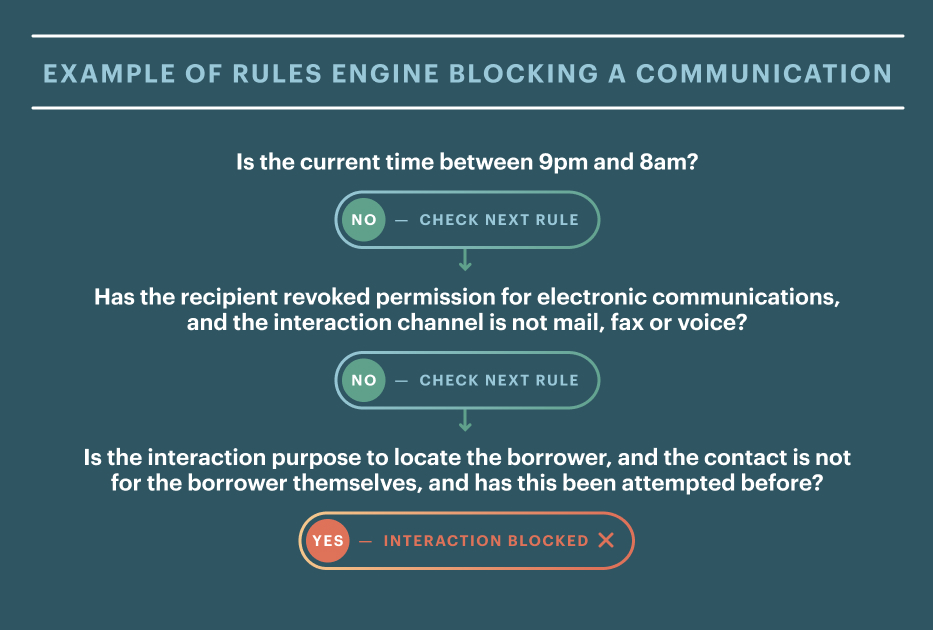

Lawmakers at various levels of government have enacted regulations affecting how lenders can communicate with borrowers. Many of these laws overlap at the city, state and federal levels, and may vary by asset class—creating a complex patchwork of requirements. Tracking which laws affect which borrowers is complicated, but Peach has created a straightforward process to help lenders stay compliant in their communications.

Whenever an outbound communication is sent, whether automatically or manually, our system loads all rules that apply to the borrower based on where they live—and runs each rule to make sure that the communication is compliant.

Alternatively, we expose an endpoint that allows a lender to check if they can interact with a given borrower without having to actually send a communication.

Alternatively, we expose an endpoint that allows a lender to check if they can interact with a given borrower without having to actually send a communication.

For example, a lender might send the following to the can_interact endpoint to see if they can make a debt collections call to the borrower:

If the call is allowed, the response from Peach would be:

We continually scan for new legislation, and code any new or modified laws into our rules engine. By default, we code rules derived directly from law text into our Rules Engine. We also have the flexibility to customize the set of rules for any given lender. If they have special circumstances that require a different subset of rules to follow, or if they want to enforce more stringent rules than are required by law, we can easily alter the set of rules that is applied to their communications, or even add custom ones. This can all be edited on the platform in real time without having to release a new update of our system.

The rules are separated into business rules, federal rules and state rules, which can be further split up by city. This means we can have custom rules that apply to everyone, just to a particular state or just to a particular city. The rules are also specific to asset class, type of origination license and servicing entity, giving lenders with multiple lending programs a high degree of flexibility.

–

Though the complexity of lending compliance is likely to increase over time, many of the compliance challenges lenders face today can be reduced or eliminated with more flexible servicing technology. If you’d like to learn more about how we can help you handle compliance in the context of your specific lending program, please contact us.